All of my clients receive the highest level of service that I have come to offer after a decade of experience. These services cover four primary areas: investment management, retirement planning, tax planning and charitable giving, depending on your personal priorities and needs. I appreciate you spending a moment with me today.

- C Garrett Moore, CFP®, ChFC®

I help answer investment questions like…

-

How can I protect myself from the next crash?

-

Am I invested in the right way?

-

Am I going to run out of money?

Are you overwhelmed by the world of investments? ETF's, 401k's, ESPP's... Who could blame you?

What if you had someone that knew you and your most sacred hopes for your life, and could give you their best advice on the investments you should use, with no incentive to "sell" you anything?

That's what I do for my clients.

I believe in using investments that have a track record of success. Not what's trendy at this time.

Add in someone keeping a close eye on your portfolio, while taking advantage of new opportunities, tax harvesting and rebalancing, and I believe that you'll be in better shape than you were before.

I help answer retirement questions like…

-

Do I have enough to retire?

-

When should I take Social Security?

-

What investments are right for me?

Changing from living off your paycheck to living off your investments can be scary and challenging.

That's where I come in.

I'm here to help you take the stress out of planning for your retirement, and to bring you over a decade of technical knowledge and experience that could improve your financial life.

I help answer tax & charitable giving

questions like:

-

How do my investment decisions affect my tax bill?

-

When might tax rates go up?

-

Can I give to charity more strategically?

-

Should I convert my Traditional IRA to a Roth IRA?

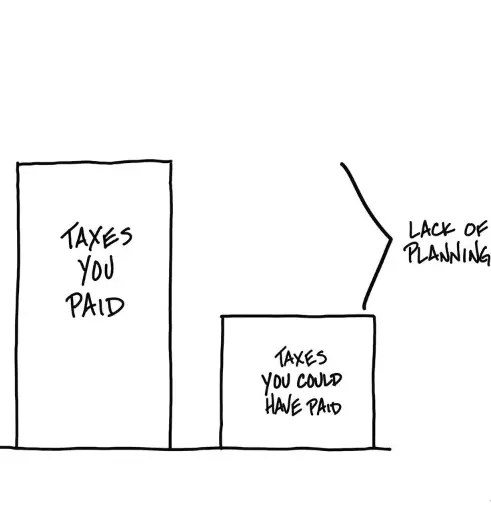

I will help you consider possible tax planning strategies to potentially reduce the taxes you will pay over the course of your life, such as:

-

Considering Roth versus Traditional IRA Contributions

-

Considering Roth Conversions

-

Charitable Giving Strategies, such as Donor Advised Funds and Qualified Charitable Distributions

-

Asset Location

-

Tax-loss Harvesting

-

Retirement Distribution Planning

I will also gladly work with your CPA or accountant to coordinate all of this for you.

If this sounds interesting, you are invited to schedule a complimentary Zoom meeting for us to get to know each other. My promise to you is that you will not be asked or pressured to buy anything at all. Just a casual conversation about what's going on in your financial life.